Learn

ABOUT Systematic Macro

from Campell

Overall ★★★★★ 3-year ★★★★★ 5-year ★★★★★ 10-year ★★★★★

Overall ★★★★★ 3-year ★★★★★

5-year ★★★★★ 10-year ★★★★★

EBSIX (I Share) received an overall, a 3-year, a 5-year, and a 10-year Morningstar Rating™ of 5-stars in the Macro Trading category. A rating out of 53 funds (overall and 3-year), 52 funds (5-year), and 31 funds (10-year) based on overall, three-, five-, and ten-year risk-adjusted returns respectively as of July 31, 2024. Please reference the Morningstar Disclosures*.

Portfolio Characteristics

Portfolio Characteristics

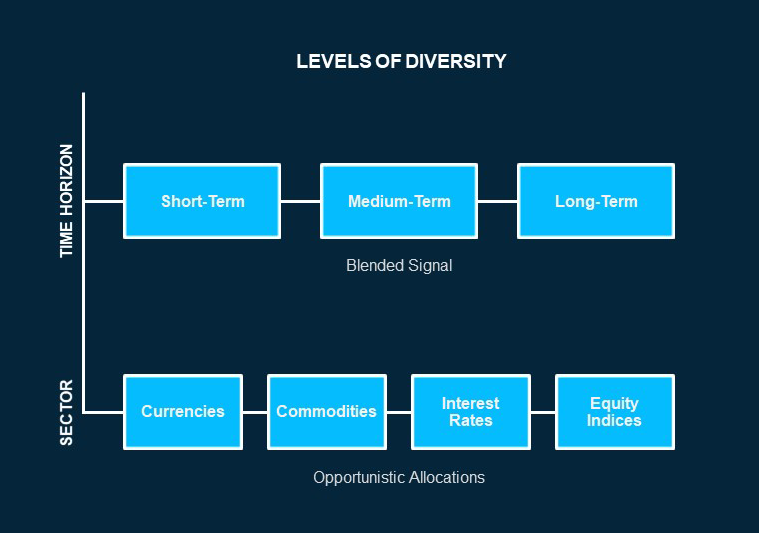

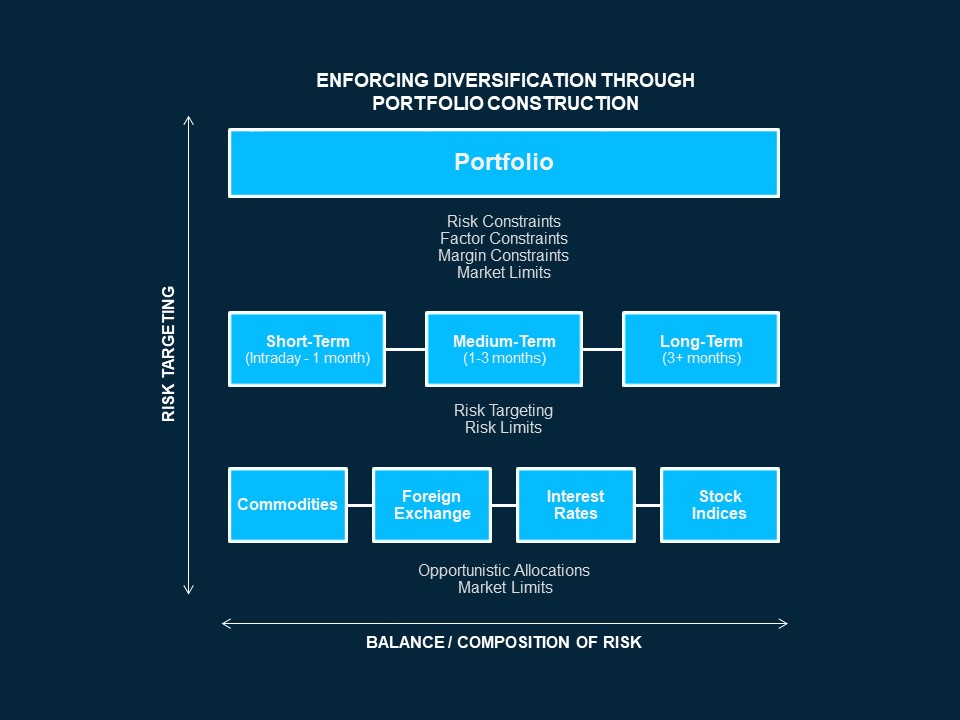

With Systematic Macro, risk is balanced across time horizons, markets and risk factors reducing maximum exposure and drawdown potential while seeking to maintain a consistent level of volatility. Additionally, Systematic Macro inherits all risk management processes and execution capabilities from Campbell’s flagship Managed Futures Program.

- Low Correlation to Traditional Investments

- 0.02 to Equities since 1988*.

- 0.02 to Equities since 1988*.

- Diversified across 3 Time Horizons

- Short-, medium-, and long-term.

- Short-, medium-, and long-term.

- Tiered Risk Management

- Risk constrained at the time horizon, portfolio, and factor levels to limit exposure and drawdown potential.

- Risk constrained at the time horizon, portfolio, and factor levels to limit exposure and drawdown potential.

- Ongoing Innovation

- Inherits all risk management processes, and execution capabilities from Campbell’s flagship program.

- Inherits all risk management processes, and execution capabilities from Campbell’s flagship program.

*Correlation of Campbell Managed Futures Portfolio to S&P 500 Index using monthly returns.

Diversification

Campbell’s Systematic Macro portfolio achieves balance over a number of dimensions. Investors are exposed to four major asset classes: equity index futures, fixed income futures, commodities and foreign exchange. The portfolio reaches across the globe, giving our investors access to a…

Diversification

Foreign Exchange*

- Australian Dollar**

- Brazilian Real

- British Pound**

- Canadian Dollar**

- Chilean Peso

- Chinese Yuan

- Colombian Peso

- Czech Koruna

- Euro**

- Hungarian Forint

- Indian Rupee

- Indonesian Rupiah

- Japanese Yen**

- Mexican Peso

- New Taiwan Dollar

- New Zealand Dollar

- Norwegian Krone

- Philippine Peso

- Polish Zloty

- Russian Ruble

- Singapore Dollar

- South African Rand

- South Korean Won

- Swedish Krona

- Swiss Franc**

Fixed Income

- Australian 90-Day Bill

- Australian 3-Year Bond

- Australian 10-Year Bond

- Bobl (Germany)

- BTP Italian Government Bond

- Bund (Germany)

- Buxl (Germany)

- Canadian 10-Year Bond

- Canadian 90-Day Bill

- Euribor (Europe)

- Euro Schatz (Germany)

- Eurodollar (USA)

- Japanese 10-Year Bond

- Long Gilt (UK)

- OAT 10-Year Bond (France)

- Short Sterling (UK)

- Treasury Note/2-Year (USA)

- Treasury Note/5-Year (USA)

- Treasury Note/10-Year (USA)

- Treasury Bond/30-Year (USA)

- Treasury Ultra Long Bond (USA)

Commodities

- Aluminum

- Cocoa

- Coffee

- Copper

- Corn

- Cotton

- Feeder Cattle

- Gold

- Heating Oil

- High Grade Copper

- KC HRW Wheat

- Live Cattle

- London Brent Crude

- London Gas Oil

- Natural Gas

- Nickel

- Palladium

- Platinum

- RBOB Gasoline

- Silver

- Soybean Meal

- Soybean Oil

- Soybeans

- Sugar #11 (World)

- Wheat

- WTI Crude Oil

- Zinc

Equity Indices

- CAC 40 Index (France)

- DAX Index (Germany)

- DJ Euro Stoxx 50 Index

- Dow Jones Index (USA)

- FTSE Index (UK)

- FTSE JSE Top 40 Index (South Africa)

- FTSE/MIB Index (Italy)

- Hang Seng Index (Hong Kong)

- IBEX35 Stock Index (Spain)

- NASDAQ 100 Index (USA)

- Nikkei 225 Index (Japan)

- OMX Stock Index (Stockholm)

- Russell 2000 Index (USA)

- S&P 400 Index (USA)

- S&P 500 Index (USA)

- S&P Canada 60 Index

- SGX FTSE Taiwan Index Future

- SGX Nifty 50 (India)

- SPI 200 Index (Australia)

- Tokyo Price Index (Japan)

** Also may be traded as cross rates

Risk Management

Diversification serves as a guiding principle for managing risk in the portfolio. The goal of the risk management process is to minimize tail risk. The portfolio construction and risk management processes continue to evolve utilizing Campbell’s commitment to cutting-edge…

Risk Management

Diversification serves as a guiding principle for managing risk in the portfolio. The goal of the risk management process is to minimize tail risk. The portfolio construction and risk management processes continue to evolve utilizing Campbell’s commitment to cutting-edge research.

In order to maintain the intended diversity in risk composition, we systematically monitor and constrain our exposure to key risk dimensions including trend time horizon (short, medium, and long term), risk factor (flight to quality, global interest rates, global stocks, commodities, etc.) and market sector (asset class, geography, liquidity, etc.).

Once the risk composition is determined, the Systematic Macro portfolio targets a stable level of volatility through time by adjusting portfolio leverage periodically.

A Look at

PERFORMANCE

for Campbell's Systematic Macro Fund

- Class I

- Class A

- Class C

- Class Overview

- Performance Details

EBSIX

Mutual Fund

FUND RISKS

The Fund pursues its investment objective by allocating up to 25% of its total assets in its wholly-owned subsidiary, Campbell Systematic Macro Offshore Limited that employs the Manager’s Campbell Systematic Macro Program and the remainder of its assets directly in a portfolio of investment grade securities (including government securities) for cash management purposes. The Campbell Systematic Macro Program seeks to systematically identify price trends and to develop macro and fundamental themes that exploit asset mispricing. In addition, a diversity of investment style and the ability to invest long and short across global asset classes and markets enables investment opportunities in a variety of economic environments. The Fund is generally intended to have a low correlation to the equity, bond and credit markets. There is no assurance, however, that the Fund will achieve its investment objective.

The Fund’s investment activities involve a significant degree of risk and are suitable only for investors with a high tolerance for investment risk including the possible loss of principal. The Fund may invest in commodities, futures, forwards, derivatives, (options and swaps) and other derivatives based on fixed income securities which are subject to credit and interest rate risk. Foreign currencies and emerging markets involves certain risks such as currency volatility, political and social instability and reduced market liquidity.

To the extent that the investment advisor misjudges current market conditions, the Fund’s volatility may be amplified by its use of derivatives, and its ability to anticipate price movements in relevant markets, underlying derivative instruments and futures contracts.

Managed futures employ leverage; they are speculative investments that are subject to a significant amount of market risk and they are not appropriate for all investors. Although adding managed futures to a portfolio may provide diversification, managed futures are not a perfect hedging mechanism; there is no guarantee that managed futures will appreciate during periods of inflation or stock and bond market declines.

The Fund is non-diversified which means it may be invested in fewer securities at any one time than a diversified fund.

The Fund intends to elect to be treated and to qualify each year, as a regulated investment company (“RIC”) under the U.S. Internal Revenue Code. To maintain qualification for federal income tax purposes as a regulated investment company under the Code, the Fund must meet certain source-of-income, asset diversification and distribution of its income requirements. If the Fund were to fail to qualify as a RIC and became subject to federal income tax, shareholders of the Fund would be subject to diminished returns.

Diversification does not assure a profit, nor does it guarantee against a loss in a declining market.

The Campbell Systematic Macro Fund is distributed by Quasar Distributors LLC, not an adviser affiliate.

~120 Futures and Forwards

Medium-Term (1-3 months)

Long-Term (3 months+)

Annualized Returns

- Class Overview

- Performance Details

FUND RISKS

The Fund pursues its investment objective by allocating up to 25% of its total assets in its wholly-owned subsidiary, Campbell Systematic Macro Offshore Limited that employs the Manager’s Campbell Systematic Macro Program and the remainder of its assets directly in a portfolio of investment grade securities (including government securities) for cash management purposes. The Campbell Systematic Macro Program seeks to systematically identify price trends and to develop macro and fundamental themes that exploit asset mispricing. In addition, a diversity of investment style and the ability to invest long and short across global asset classes and markets enables investment opportunities in a variety of economic environments. The Fund is generally intended to have a low correlation to the equity, bond and credit markets. There is no assurance, however, that the Fund will achieve its investment objective.

The Fund’s investment activities involve a significant degree of risk and are suitable only for investors with a high tolerance for investment risk including the possible loss of principal. The Fund may invest in commodities, futures, forwards, derivatives, (options and swaps) and other derivatives based on fixed income securities which are subject to credit and interest rate risk. Foreign currencies and emerging markets involves certain risks such as currency volatility, political and social instability and reduced market liquidity.

To the extent that the investment advisor misjudges current market conditions, the Fund’s volatility may be amplified by its use of derivatives, and its ability to anticipate price movements in relevant markets, underlying derivative instruments and futures contracts.

Managed futures employ leverage; they are speculative investments that are subject to a significant amount of market risk and they are not appropriate for all investors. Although adding managed futures to a portfolio may provide diversification, managed futures are not a perfect hedging mechanism; there is no guarantee that managed futures will appreciate during periods of inflation or stock and bond market declines.

The Fund is non-diversified which means it may be invested in fewer securities at any one time than a diversified fund.

The Fund intends to elect to be treated and to qualify each year, as a regulated investment company (“RIC”) under the U.S. Internal Revenue Code. To maintain qualification for federal income tax purposes as a regulated investment company under the Code, the Fund must meet certain source-of-income, asset diversification and distribution of its income requirements. If the Fund were to fail to qualify as a RIC and became subject to federal income tax, shareholders of the Fund would be subject to diminished returns.

Diversification does not assure a profit, nor does it guarantee against a loss in a declining market.

The Campbell Systematic Macro Fund is distributed by Quasar Distributors LLC, not an adviser affiliate.

~120 Futures and Forwards

Medium-Term (1-3 months)

Long-Term (3 months+)

- Class Overview

- Performance Details

Mutual Fund

FUND RISKS

The Fund pursues its investment objective by allocating up to 25% of its total assets in its wholly-owned subsidiary, Campbell Systematic Macro Offshore Limited that employs the Manager’s Campbell Systematic Macro Program and the remainder of its assets directly in a portfolio of investment grade securities (including government securities) for cash management purposes. The Campbell Systematic Macro Program seeks to systematically identify price trends and to develop macro and fundamental themes that exploit asset mispricing. In addition, a diversity of investment style and the ability to invest long and short across global asset classes and markets enables investment opportunities in a variety of economic environments. The Fund is generally intended to have a low correlation to the equity, bond and credit markets. There is no assurance, however, that the Fund will achieve its investment objective.

The Fund’s investment activities involve a significant degree of risk and are suitable only for investors with a high tolerance for investment risk including the possible loss of principal. The Fund may invest in commodities, futures, forwards, derivatives, (options and swaps) and other derivatives based on fixed income securities which are subject to credit and interest rate risk. Foreign currencies and emerging markets involves certain risks such as currency volatility, political and social instability and reduced market liquidity.

To the extent that the investment advisor misjudges current market conditions, the Fund’s volatility may be amplified by its use of derivatives, and its ability to anticipate price movements in relevant markets, underlying derivative instruments and futures contracts.

Managed futures employ leverage; they are speculative investments that are subject to a significant amount of market risk and they are not appropriate for all investors. Although adding managed futures to a portfolio may provide diversification, managed futures are not a perfect hedging mechanism; there is no guarantee that managed futures will appreciate during periods of inflation or stock and bond market declines.

The Fund is non-diversified which means it may be invested in fewer securities at any one time than a diversified fund.

The Fund intends to elect to be treated and to qualify each year, as a regulated investment company (“RIC”) under the U.S. Internal Revenue Code. To maintain qualification for federal income tax purposes as a regulated investment company under the Code, the Fund must meet certain source-of-income, asset diversification and distribution of its income requirements. If the Fund were to fail to qualify as a RIC and became subject to federal income tax, shareholders of the Fund would be subject to diminished returns.

Diversification does not assure a profit, nor does it guarantee against a loss in a declining market.

The Campbell Systematic Macro Fund is distributed by Quasar Distributors LLC, not an adviser affiliate.

02/11/2014

~120 Futures and Forwards

Medium-Term (1-3 months)

Long-Term (3 months+)

The Adviser has contractually agreed to waive certain fees and/or reimburse expenses until December 31, 2024. Furthermore, the Adviser may recoup from the Fund any waived amount or other payments remitted within three years from the date on which such waiver or reimbursement was made if such reimbursement does not cause the Fund to exceed expense limitations that were in effect at the time of the waiver or reimbursement.

PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU CAN LOSE MONEY IN A MANAGED FUTURES PROGRAM.

Performance shown prior to 06/01/2020 is that of the predecessor fund, Equinox Campbell Strategy Fund.

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at 1-800-698-7235. Performance would have been lower without fee waivers in effect.

Experience

The Campbell Difference

for Yourself

Specialists with

Experience

We have approximately 80 employees, with more than half focused on research, research operations and trading. We source talent with top educational backgrounds and a variety of relevant work experience. Our traders are seasoned in market fundamentals, global exchanges and various trading platforms and our established executive committee has significant industry experience.

Disciplined, Systematic

Approach

At Campbell, we rely on quantitative methods to develop rules-based strategies, expressed through a multi-tiered portfolio construction process. Our systematic approach eliminates the emotional component from investing, which can often lead to poor outcomes.

Multi-Disciplinary

Research Team

Our diverse group of researchers, which includes top talent from the fields of physics, economics and applied mathematics, to name a few, brings unique and complementary insights to strategy development. Many of our researchers hold doctoral or master’s degrees from the world’s best universities. Our open and supportive culture helps retain our best performing employees. Our partnerships with leading local academic institutions provide access to the most promising job candidates in the region.

Scalable Investment

Management

We currently manage assets for a broad array of institutional and private clients around the world. We are also proud to offer a wide range of single-strategy and multi-strategy products.

Download Systematic Macro

FUND MATERIALS

Campbell Systematic Macro Fund Presentation

Campbell Systematic Macro Fund Performance Update

Campbell Systematic Macro Fund Prospectus

Campbell Systematic Macro Fund Statement of Additional Information

Portfolio Holdings

> Most Recent Month

> Most Recent 1st Qtr (Dec-Feb)

> Most Recent 2nd Qtr (Mar-May)

> Most Recent 3rd Qtr (Jun-Aug)

> Most Recent 4th Qtr (Sep-Nov)

Annual Report

Semi-Annual Report

Campbell Systematic Macro Fund Informational Summary

Campbell Systematic Macro Fund Latest Distribution

Latest proxy voting results

CONTACT US

2850 Quarry Lake Drive, Baltimore, MD 21209

* The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. Morningstar Rating is for the I-Share class only; other classes may have different performance characteristics.

©2020 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Fund ratings are only one form of performance measurement. For the most current performance please refer to the ‘Class Performance’ tab(s).